georgia property tax exemptions disabled

We apologize for any inconvenience. Secretary of Veterans Affairs.

States With Property Tax Exemptions For Veterans R Veterans

Secretary of Veterans Affairs.

. The additional sum is determined according to an index rate set by United States Secretary of Veterans Affairs. Net income from rental property. The current amount is 85645.

If you are 65 years old or older and your net income the previous year wa s 10000 or less you qualify for a 4000 property tax exemption. If youre 62 years old or older and living within a school district and your annual family income is 10000 or less then up to 10000 of your. 4000 off school bond taxes.

Property in excess of this exemption remains taxable. Applicants may also qualify for this exemption if 100 disabled regardless of age with a signed letter from your doctor stating you are unable to be gainfully employed. To receive the benefit of the homestead exemption the taxpayer must file an initial application.

Georgia Property Tax Exemptions. 4000 off county bond taxes. Georgia doesnt have a capital gains tax.

Must be age 65 on or before January 1. The GDVS can only verify the status of a. 100 disabled persons of any age can apply for this exemption.

To continue receiving this benefit a letter from the Veterans Administration. System Maintenance - Georgia Tax Center and Alcohol Licensing Portal. When applying you must provide proof of Georgia residency.

New signed into law May 2018. Up to 25 cash back Senior Citizen Exemptions From Georgia Property Tax. The times to file are from 800am to 500 pm Monday through Friday excluding holidays.

Disabled veterans their widows or minor children can get an exemption of 60000. 7000 off recreation taxes. Adjudicated as being totally and permanently 100 disabled.

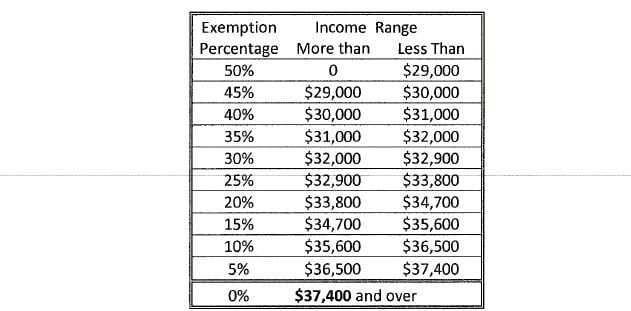

Veterans Exemption - 100896 For tax year 2021 Five ways to be eligible. Letter from VA stating the wartime veteran was. If you are above a certain age and have the qualifying income you may be eligible for additional amounts of exemption.

10000 off county taxes. Georgia offers two possible ways for data centers to qualify for sales and use tax exemptions on qualifying purchases. The 2020 Basic Homestead Exemption is worth 27360.

Your Georgia taxable net income for the preceding taxable year cannot exceed 10000. A letter from the Veterans Administration stating that the veteran has a 100 Service Connected Disability and is totally and permanently disabled is required to qualify for this exemption GA Code 48-5-48. It exempts the applicant from all school and state taxes and provides exemption of 101754 for all other levies.

Applies to all Fulton ad valorem levies in the amount of 4000. 4000 FULTON COUNTY EXEMPTION. Individuals 65 years or older may claim an exemption from all state ad valorem taxes on their primary legal residence and up to 10 acres of land surrounding the residence.

To apply for a disabled exemption you will need to bring your Georgia drivers license your Social Security Awards Letter and one Doctors Affidavit completed by your doctor. Compare to line 15C of your Georgia tax return. Taxpayers who are 62 or older or permanently and totally disabled regardless of age may be eligible for a retirement income adjustment on their Georgia tax return.

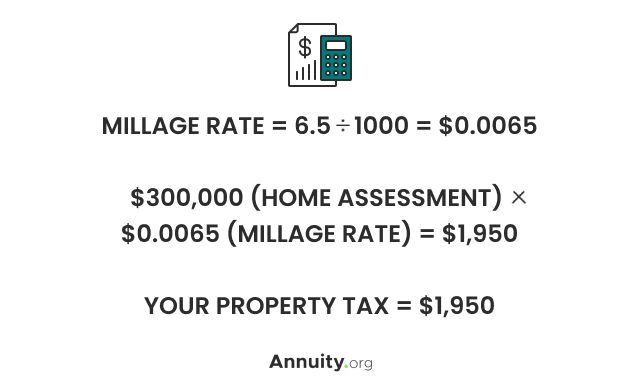

A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US. Includes 10000 off the assessed value on County4000 off County bond10000 off school 10000 off school bond and. 4000 off school taxes.

People living in the house cannot have a total income of more than 30000. Receiving or entitled to receive benefit for a 100 service connected disability. The exemptions apply to homestead property owned by the taxpayer and occupied as his or her legal residence some exceptions to this rule apply and your tax commissioner can explain them to you.

Maintenance on Georgia Tax Center and Alcohol Licensing Portal will occur Sunday June 12 from 400 pm to 1200 am. Pensions and disability income up to the maximum. If you are a 100 disabled veteran you may be eligible for additional amounts of exemption.

In addition you are automatically eligible for a 10000 exemption in the school general tax category. Do disabled veterans pay state taxes in. To be eligible for this exemption you must meet the following requirements.

To obtain verification letters of disability compensation from the Department of Veterans Affairs please call 1-800-827-1000 and request a Summary of Benefits letter. Georgia provides property tax exemptions for homeowners people aged 62 and older disabled veterans and the surviving spouses of US. Exemptions are filed with the Board of Assessors located at 222 West Oglethorpe Ave Suite 113 Savannah Georgia 31401 1st Floor of the Pete Liakakis Government Building.

This is a 10000 exemption in the county general and school general tax categories. Disabled Georgia vets with qualifying disabilities 100 VA ratings loss or loss of use of hands feet eyesight etc may receive a property tax exemption up to 60000 for a primary residence. If a member of the armed forces dies on duty their spouse can be granted a property.

Disabled Person - 50 School Tax Exemption coded L5 or 100 School Tax Exemption coded L6 If you are 100 disabled you may qualify for a reduction in school taxes. Surviving spouses and surviving children may also be eligible for this property tax exemption. Discharged under honorable condition.

Suite 203 - Real Property Tax Returns and Homestead Applications Suite 213 Personal Property Division. Co-located data centers and single-user data centers that invest 100 million to 250 million in a new facility may qualify for a full sales and use tax exemption on eligible expenses which. Income from pensions and annuities.

Both systems will be unavailable during those times. Any qualifying disabled veteran may be granted an exemption of up to 50000 plus an additional sum from paying property taxes for county municipal and school purposes. The telephone number is.

There is a household income limit of 10000 Georgia Net Income. There are several homestead exemptions offered by the State of Georgia that apply specifically to senior citizens. Cobb County School Tax Age 62 This is an.

Service members and peace officers or firefighters. S5 - 100896 From Assessed Value. Additional Tax Exemptions Property Tax Exemptions.

Any questions pertaining to tax exemptions at the local level should be asked to and answered by your County Tax Commissioners office. A disabled veteran in Georgia may receive a property tax exemption of 60000 or more on hisher primary residence if the veteran is 100 percent disabled depending on a fluctuating index rate set by the US. Exemptions may vary based on which county the veteran resides.

Property Taxes in Georgia. The exemption amount varies. Disabled veterans who have reached the age of 65 as of January 1st AND meet the requirements for the H5 Disabled Veterans exemption above may be eligible.

Residents over 65 with a household net income under 10000 a year may be eligible.

Find Out If There Are Any States With No Property Tax In 2020 Which States Have The Lowest Property Taxes States Property Tax Property Real Estate Investor

Property Taxes Calculating State Differences How To Pay

Are There Any States With No Property Tax In 2021 Free Investor Guide Property Tax South Dakota States

Public Hearing To Address Property Tax Exemptions News Oswegocountynewsnow Com

Property Tax Exemption Who Is Exempt From Paying Property Taxes

Respect The Flags Respect The Flag Safety Topics Bury

States That Fully Exempt Property Tax For Homes Of Totally Disabled Veterans

What Is A Homestead Exemption And How Does It Work Lendingtree

Property Taxes By State In 2022 A Complete Rundown

I Also Have Friends Who Dont Have To Pay Property Tax After Getting Medical Disability Does Fox News Want This To Go Away R Military

Property Overview Cobb Tax Cobb County Tax Commissioner

Property Taxes Calculating State Differences How To Pay