bexar county tax office property search

Free Bexar County Assessor Office Property Records Search Find Bexar County residential property tax assessment records tax assessment history land improvement values district details property maps tax rates exemptions market valuations ownership past sales deeds. Truth-in-taxation is a concept embodied in the Texas Constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to.

Real Property Land Records Bexar County Tx Official Website

Within this site you will find information about the ad valorem property tax system in Texas and Bexar County property details.

. This service includes filing an exemption on your residential homestead property submitting a Notice of Protest and receiving important notices and other information online. Free Bexar County Treasurer Tax Collector Office Property Records Search. The AcreValue Bexar County TX plat map sourced from the Bexar County TX tax assessor indicates the property boundaries for each parcel of land with information about the landowner the parcel number and the total acres.

Southside - 3505 Pleasanton Rd. The district appraises property according to the Texas Property Tax Code and the Uniform Standards of. Ad Enter Any Address Find Previous Property Owner Records for Your State.

Reports Record Searches. Get Property Records from 2 Treasurer Tax Collector Offices in Bexar County TX Bexar County Tax Collector 233 N Pecos La Trinidad San Antonio TX 78283 210-335-2251 Directions Bexar County Tax Collector 640 Southwest Military Drive San Antonio. The records to which access is not otherwise restricted by law or by court order are made available through our Public Records Search.

AcreValue helps you locate parcels property lines and ownership information for land online eliminating the need for plat books. Bexar Appraisal District is responsible for appraising all real and business personal property within Bexar County. The Online Portal is also available to agents that have been authorized to represent an owner under section 1111 of the Texas Property Tax Code.

Find Bexar County residential property records including owner names property tax assessments payments rates bills sales transfer history deeds mortgages parcel land zoning structural descriptions valuations more. These buyers bid for an interest rate on the taxes owed and the right to collect back. Search All of the Most Up-to-Date Foreclosure Listings Available Near You.

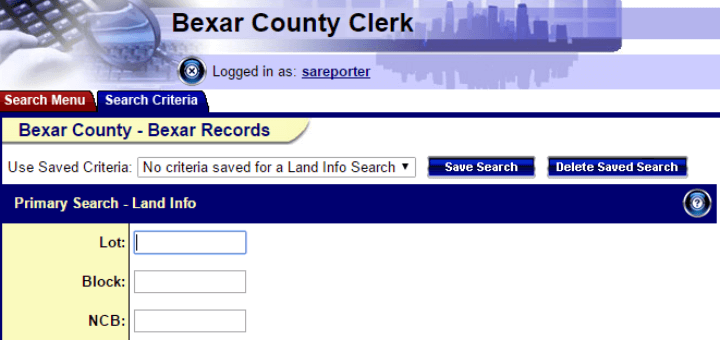

County office is not a credit reporting agency as defined by the fair credit reporting act fcraBexar County Tx Tax. Ad HUD Homes USA Can Help You Find the Right Home. Go to Type of Search and select the Search Criteria of Owner Name last name first name.

Link to the State Comptrollers site to find out about property taxes as they pertain to the taxpayer. The 86th Texas Legislature modified the manner in which the voter-approval tax rate is calculated to limit the rate of growth of property taxes in the state. Bexar County Payment Locations.

For inquiries pertaining to foreclosures please contact the County Clerks Office. San Antonio TX 78283. Return to Account Search Go to Your Portfolio.

San Antonio TX 78207. Owner Name Last name first. Search Property Tax Overpayments.

Owner Name Last name first Property Address Account Number CAD Reference Number. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Bexar County TX at tax lien auctions or online distressed asset sales. Property Tax Payment Options.

For questions regarding tax statements andor property taxes owed visit the County Tax Office Website email or call 210 335-2251. You can PREPAY your taxes escrow for the. Justice of the Peace Online Payments.

Northeast - 3370 Nacogdoches Rd. For questions regarding tax amounts visit the County Tax Office Website email or call 210 335-2251. Property Tax Account Search.

For questions regarding your tax statement contact the Bexar County Tax Assessor-Collectors Office at 2103356628. Tax Bills Who to Contact for Tax Bills. 210 354-2244 View Profile.

Contact Us Executive DirectorChief Appraiser Dinah L there is a 5. Bexar County Official Public Records. Bexar County TX currently has 1633 tax liens available as of July 20.

Enter an account number owners name last name first address CAD reference number then select a Search By option. The following map displays mortgage and tax foreclosure notices. Pecos La Trinidad.

Northwest - 8407 Bandera Rd. Bexar County Property Records Address. Downtown - 233 N.

Property Tax Overpayments Search. It is not a comprehensive listing of all deaths in bexar county. 411 North Frio Street.

Bexar County Tax Office Mercedes M139 Engine For Sale email protected Bexar County Tax Office. 24165 IH 10 West Suite 217 230 San Antonio TX 78232 Phone. Child Support Online Payments.

411 North Frio Street San Antonio TX 78207 Mailing Address. Get property records from 3 assessor offices in bexar county tx. The Bexar County Clerks Office Recordings Division files records and maintains Real Property Records Personal Property Records Notice of Trustee Sales Military Discharges and Public Notices.

100 dolorosa san antonio tx 78205 phone. A clickable pop-up includes basic property information.

Information Lookup Bexar County Tx Official Website

Guadalupe County Tax Office Home

High Bexar County Property Values Prompt Residents To Learn The Art Of Protesting Or Find A Consultant

Deadline Arrives For Property Appraisal Protests In Bexar County Tpr

Bexar County Cities Ranked By Property Tax Rate Total During 2016 San Antonio Business Journal

As Property Tax Bills Arrive Protesters Are Encouraged To Act Now Woai

Bexar County Property Owners Have Until May 17 To Appeal 2021 Property Appraisals Officials Say

Property Tax Information Bexar County Tx Official Website

Property Tax Information Bexar County Tx Official Website

Bexar County Texas Property Search And Interactive Gis Map

Public Service Announcement Residential Homestead Exemption

How To Research A Property S History Using Bexar County S Free Records Search John Tedesco

County Commissioners Vote To Decrease Property Tax Rate In 2022

Public Record Searches Bexar County Tx Official Website

:strip_exif(true):strip_icc(true):no_upscale(true):quality(65)/cloudfront-us-east-1.images.arcpublishing.com/gmg/FIN4Q7VOD5GDFMHBKTNEEM7YCY.jpg)